Solution business

Expansion of our loan guarantee business and creation of new businesses and services

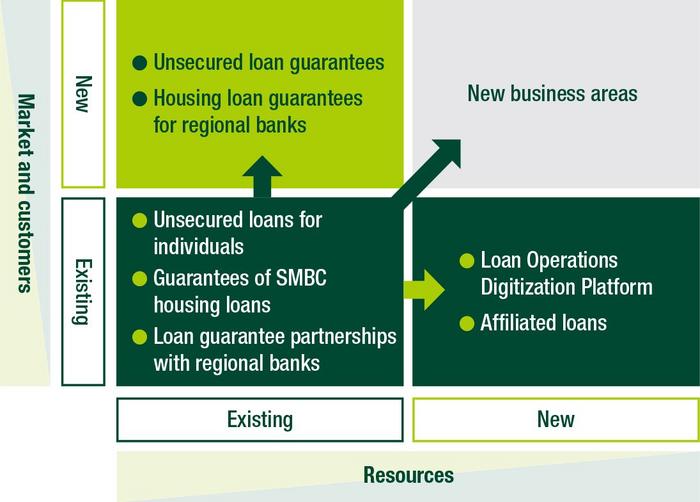

Our medium-term management plan for fiscal 2023 onward states “expanding into new business areas” as one of our strategies, and we are working to create new businesses and services while further expanding our loan guarantee business by providing solutions designed for financial institutions. As solutions for financial institutions, we are promoting the planning and sales of (1) external guarantees for housing loans, (2) provision of the Loan Operations Digitization Platform, and (3) new partnerships in guaranteeing personal loans.

External guarantees for housing loans

By building a system of collaboration with SMBC Guarantee Co., Ltd., which became our subsidiary in 2022, we are newly selling guarantees for housing loan products offered by regional financial institutions.

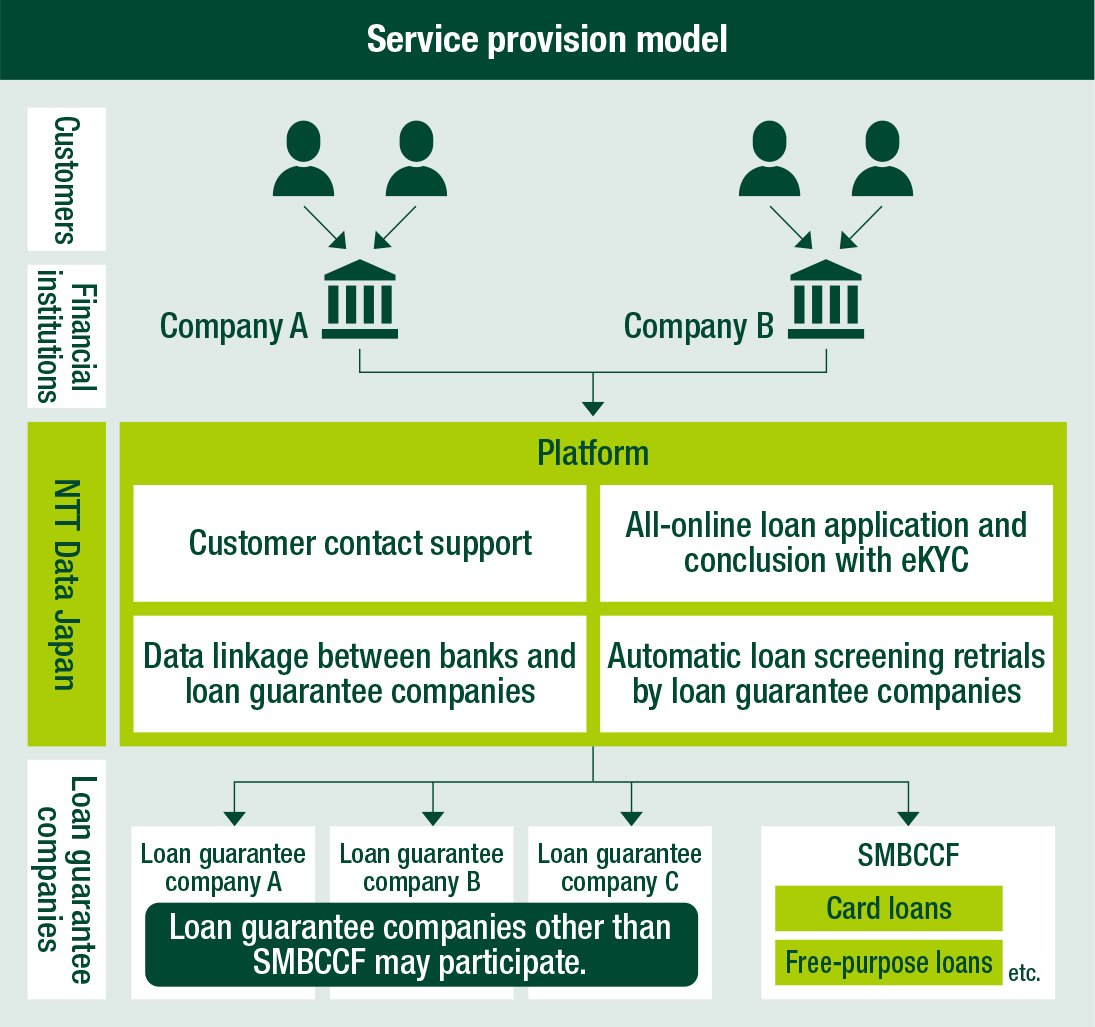

Provision of the Loan Operations Digitization Platform

In collaboration with NTT Data Japan Corporation, we have built a platform that supports the digitalization of overall operations regarding loans, and we have begun providing the platform to financial institutions. In the personal loan business, financial institutions and loan guarantee companies are faced with inflated system costs and more complicated administrative operations. By resolving these issues through the realization of digital transformation and providing new value to financial institutions and users, we aim to contribute to the expansion of the personal loan market and become the industry standard.

New partnerships in guaranteeing personal loans

Leveraging the expertise we have developed in credit and loan management, we currently partner with 188 financial institutions to provide them with personal loan guarantees. Aiming to further expand our loan guarantee business, we are promoting new loan guarantee partnerships with financial institutions by strengthening our collaboration with the SMBC Group and providing the Loan Operations Digitization Platform. For the creation of new businesses and services, we are promoting collaboration and co-creation with corporate customers, mainly based on the SMBC Group’s customer base. By leveraging the expertise we have cultivated in consumer finance, we aim to propose solutions that may contribute to the revitalization of our partners’ core business and their business diversification, thereby developing our new business models.