Governance

Basic Stance on Corporate Governance

We believe that effective corporate governance is integral to the prosperous coexistence of SMBC Consumer Finance and its group companies with society as a trusted corporate citizen. To this end, we constantly strive to strengthen our management structure, improve our internal control and audit systems and further improve the efficiency, soundness and transparency of management through the prompt and fair disclosure of corporation information on a pillar of ethical and legal compliance.

Corporate Governance System for Managerial Decision-Making, Performance and Supervision Functions

1. Board of Directors

Since June 2002, we has implemented an executive officer system by dividing business execution” and overseeing functions”. The Board of Directors consists of four (4) directors (as of April 1, 2025) in order to carry out accurate and quick decision-making based on adequate discussions. As a managerial/supervisory body and the highest decision-making body, the Board of Directors meets regularly once a month and convenes extraordinary Board of Directors’ meetings whenever necessary, deliberates over legally established matters and important management-related items, and continuously supervises the execution of business. Also, as and when necessary, matters that are discussed by the Board of Directors are subject to preliminary deliberation by the Management Committee, which is comprised of directors and other members, ensuring that adequate discussions are held.

2. Management Committee

Usually on a weekly basis, we a Management Committee made up of executive officers nominated by the president to deliberate over important management-related items based on policies and strategies resolved by the Board of Directors, as well as to share information relating to management tasks. Including those who hold concurrent posts as directors, twenty one (26) executive officers have been appointed (as of April 1, 2025).

3. Auditors

We adopts an auditor system with three (3) nominated auditors. The auditors attend the company`s important meetings, including meetings of the Board of Directors, and receive business reports from the directors, as well as auditing directors’ execution of duties through browsing important documents for approval, as well as reports of hearings from the Internal Audit Department, SMBC Consumer Finance Group companies and financial auditors, etc. The auditors also observe and verify whether Internal Control Systems are appropriately maintained by SMBC Consumer Finance and Group companies, including Compliance and Risk Management Systems, from the viewpoint of strengthening systems to ensure suitable business at corporate groups, and whether these are functioning effectively. In addition, audit bureaus are established independently from directors’ chain of command with the aim of assisting auditors in their work and perfecting audit functions.

4. All kinds of Committees

We has established all kinds of internal committees on a cross-departmental basis with the aim of strengthening its internal control functions and risk management. These committees are convened periodically or whenever necessary, deliberating over management tasks in their individual respective fields and offering opinions to the Board of Directors, etc. A summary of the main committees is provided below.

- a. Compliance and Risk Management Committee

- Convened in principle more than 4 times a year or whenever necessary, the Compliance and Risk Management Committee discusses necessary measures to strengthen compliance and ascertains and appropriately manages all risks throughout the whole Group, and aims to minimize damage by providing flexible support across the whole company when any risk is actualized.

- b. Disciplinary Committee

- Convened whenever necessary, the Disciplinary Committee aims to improve employee morale and ensure complete order through suitable management of commendation and discipline.

- c. Committee for Countermeasures against money laundering and Antisocial Forces

- Convened in principle more than twice a year , the Committee for the Separation from Antisocial Forces and Anti-Money laundering and combating the Financing of Terrorism promotes company-wide discussion of various policies for the exclusion of antisocial forces and maintains a unified Group conditions .

- d. Customer Experience Improving Committee

- Convened in principle once every half year , the Customer Experience Improving Committee strives to enhance customer experience value through the planning and consideration of policies and measures for the company-wide penetration and activation of Customer-Oriented Initiatives.

Corporate Governance

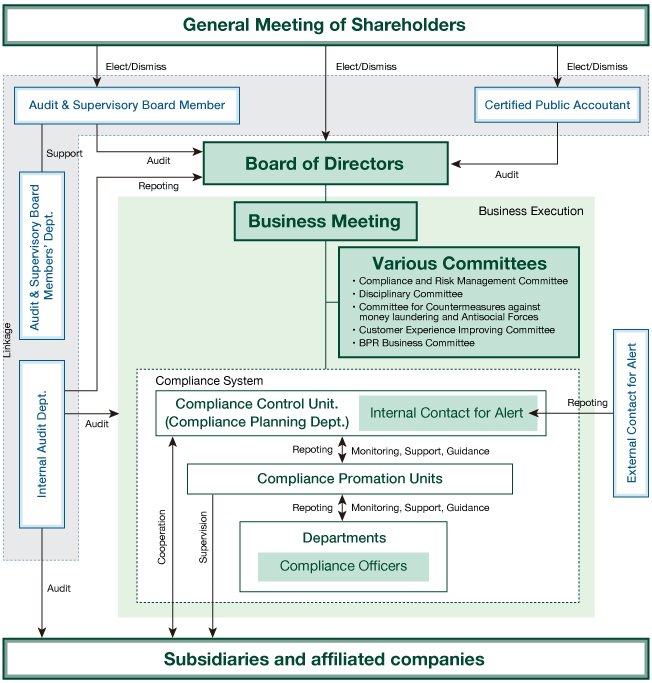

In diagram form, our Corporate Governance System is as follows.(Current as of October 1, 2024)

Enhancement of Compliance Framework

We adhere to our core policy of maintaining sustained growth and a sound financial base through business management from a long-term perspective. Our policy also calls for the timely and accurate disclosure of information, and consistently maintaining sound relationships with our customers and other stakeholders.

Full enforcement of compliance

Positioning thorough compliance as one of our most important management issues, we are committed to ensuring that our actions are not merely in compliance with laws and regulations, but are supported by society at large, including social norms, by making it a principle to act with high ethical standards and sincerity as professionals, based on a spirit of integrity. We are working to enhance and strengthen our compliance system and foster and instill a compliance culture through the development of internal regulations and an organizational structure, in-house education, and ongoing awareness-raising activities. Our organizational structure for compliance consists of the Compliance Planning Department, which serves as a compliance supervisory department, the compliance promotion unit, which is responsible for promoting internal controls in operations divisions, and compliance officers appointed in each department. They all work to ensure compliance with relevant lawsand regulations and social norms. The Internal Audit Department regularly audits these systems and activities from an independent standpoint to verify their appropriateness. Furthermore, we have also set up consultation desks both inside and outside the company to enhance our self-cleaning function through the early detection and correction of violations of laws and regulations. We are working to enhance our internal reporting system in accordance with the Whistleblower Protection Act.

Response to antisocial forces

We have organized our preparedness for severing all relationships with antisocial forces by establishing a basic policy on how to deal with these forces. We have established the Basic Policy on the Exclusion of Antisocial Forces to sever and eliminate relationships with antisocial forces in a determined attitude, maintain public confidence in SMBC Consumer Finance, ensure businesses are run appropriately, and prevent damage caused by antisocial forces.

- <Basic Policies>

-

1. We will hold no relationships with antisocial forces.

2. We will deal with antisocial forces appropriately in an organized manner by cooperating with the police, the National Center for Removal of Criminal Organization, lawyers, and other external agencies.

3. We will not comply with undue claims from antisocial forces, and will resolutely take a legal action against these claims.

4. We will refuse to provide funds to antisocial forces and engage in secret transactions with them.

5. We will ensure the safety of employees and protect them from the undue claims of antisocial forces.

Measures against money laundering, terrorism financing, and financial crimes

We are taking steps to prevent the violation of regulations on money laundering and terrorism financing based on requests from international organizations such as FATF* and countries concerned, as well as laws and regulations in Japan and other countries, to secure appropriate business operations. In addition, to combat fraudulent transactions, etc., we have established a company-wide framework and are considering and implementing various measures in cooperation with public institutions.

*An abbreviation for the Financial Action Task Force.

Conducting fair transactions

SMBC Consumer Finance maintains an open attitude when selecting business and retail partners and establishing new trading relationships. To ensure the development and maintenance of sound relationships, we have established guidelines to regulate our operations related to the selection of trading counterparties. Based on these guidelines, we determine trading counterparties by fairly comparing their prices, quality, services, and other related conditions in light of factors such as the content of their business and financial performance. This allows us to conduct business in a sincere manner with our business partners.

Business Continuity Plan(BCP)

We have established procedures in relation to emergency measures, in order to respond promptly and appropriately in the event of an emergency such as natural disasters. In addition, we have formulated a Business Continuity Plan (BCP)to ensure business continuity and early recovery from such events. We conduct ‘BCP Training’ on a regular basis, including various trainings on initial response and other measures upon large-scale disasters (earthquake, volcanic eruption, etc.). Through these on-going trainings, issues are identified and improvements considered to enhance our emergency response system.