Finance Business

Business Outline

Financing services that provide greater convenience for customers

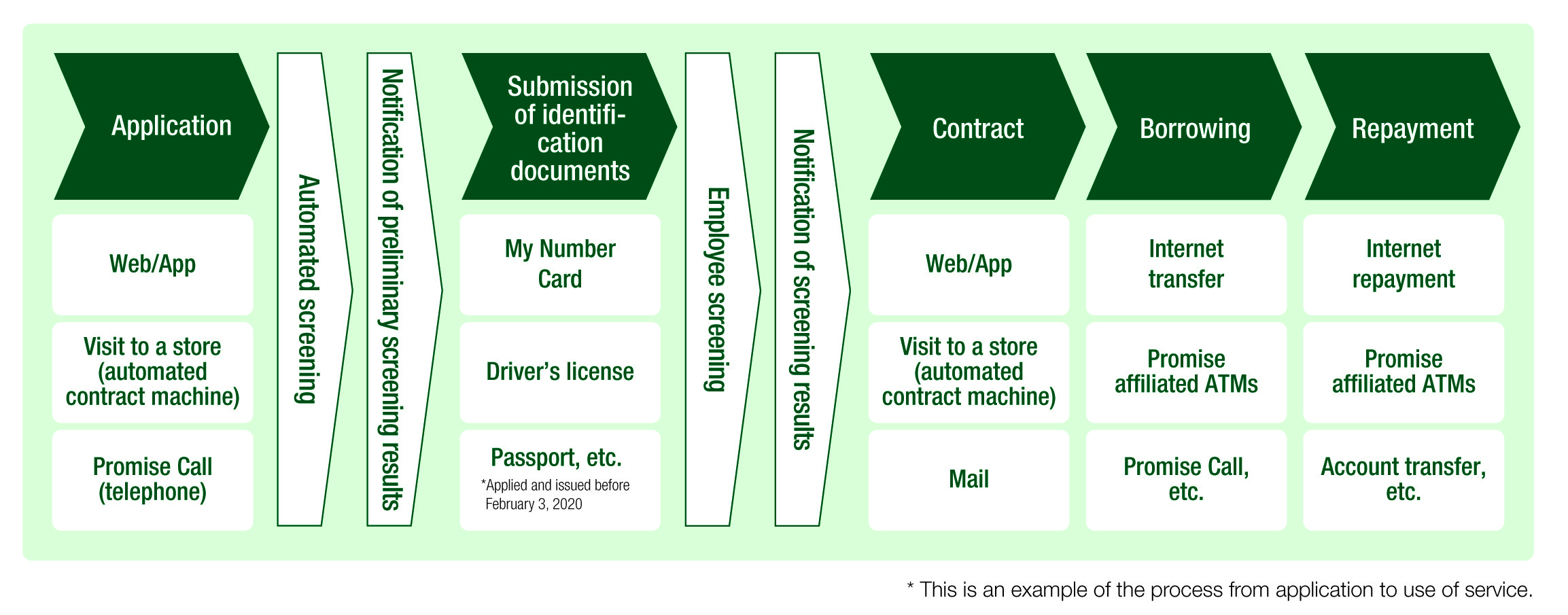

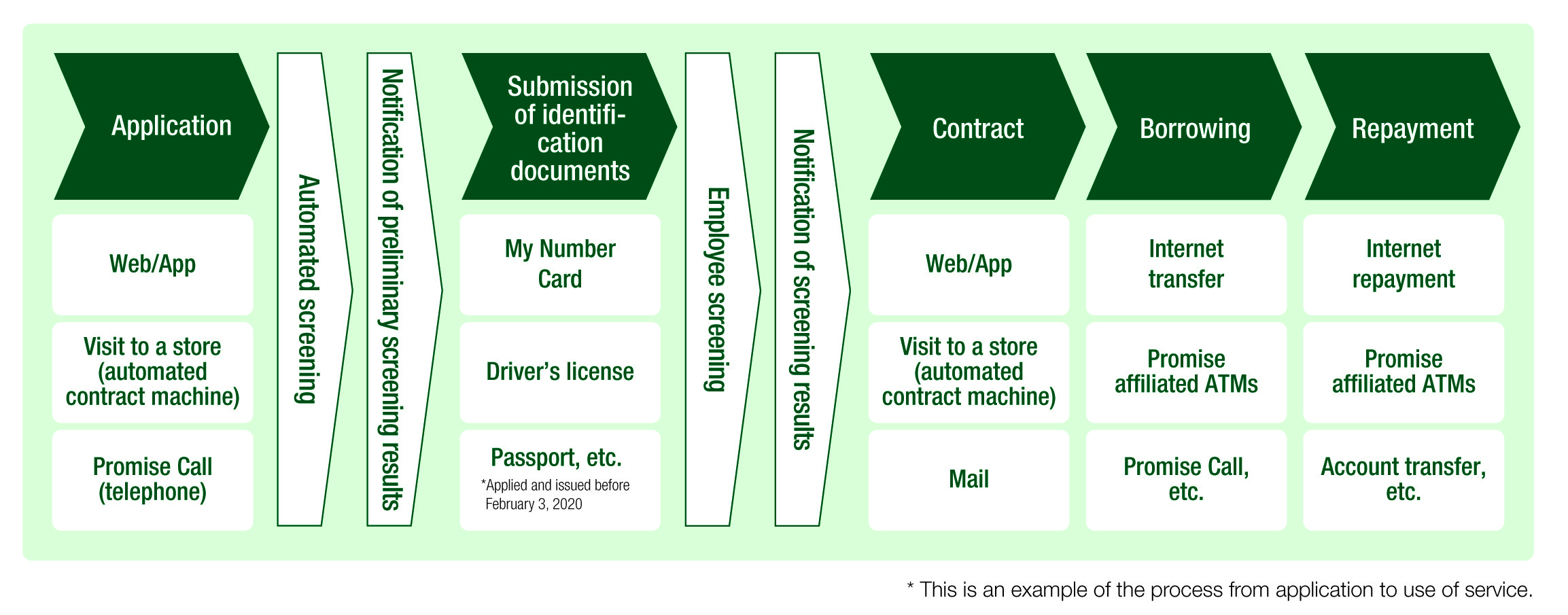

PROMISE is one of our financing business arms. Its main offering is Free Cashing (revolving loans), which meets the various borrowing needs of individual customers. Other offerings include Card Loans for the Self-employed, which meet the funding needs of self-employed individuals, and Consolidation Loans, which aim to ease the burden on those who are repaying multiple loans. In recent years, we have introduced various new services, including App Loans using our official app Promise as a platform, the V Point system, a shared point reward service for the SMBC Group, and issuance of Promise Visa cards with a credit function provided by Sumitomo Mitsui Card Co., Ltd. In October 2023, we renewed our brand logo and slogan and launched new advertising to embody our new brand concept of supporting everyone’s lifestyle (Promise =Lifestyle Support Brand). Starting in January 2024, in order to respond to customers’ financial needs more quickly and enhance convenience, we have introduced a service that allows customers to submit their income information via Seven Bank ATMs using their My Number Card and a “digital screening” service that completely digitizes the process from application to borrowing. Furthermore, in March 2025, we introduced digital identity verification using My Number Card authentication and a function to obtain income information through the Mynaportal API, which has enhanced identity verification and enabled faster screening.

Various channels available to meet different customer needs

We have established a network of various channels in order to promptly meet the needs of customers wishing to use services anytime and anywhere with peace of mind, as well as the expectations of potential customers who have concerns about borrowing money and consultations regarding repayment. At our Customer Service Centers, we receive and screen loan applications and provide consultation and guidance on borrowing and repayment through contactless channels, including the Internet, automated loan contracting machines, and telephone. The Centers’ constant efforts to improve customer response quality have resulted in 12 consecutive years of COPC®* certification, an international quality assurance standard for contact centers, since 2013. The Customer Support Center offers customer-oriented repayment consultations. It is also in charge of the management and collection of overdue loans in the financing business and reimbursement claims in the cooperation business and of the handling of legal matters. By pursuing “genuine repayment consultation” to understand the situation and needs of customers, address their repayment concerns head-on, and provide proposals and guidance to solve their problems, the Center aims to support customers both today and in the future.

* The COPC®CX Standard Customer Operation Version Release 7.0.

It is a global quality assurance standard developed specifically for contact center operations to improve customer satisfaction and ensure efficient operations.

It certifies contact centers that have fulfilled and maintained the prescribed standards to an excellent level, particularly in relation to customer response performance.

Application to contract process, borrowing and repayment