Cooperation Business

Business Outline

Expanding the loan guarantee business, and applying our credit investigation expertise

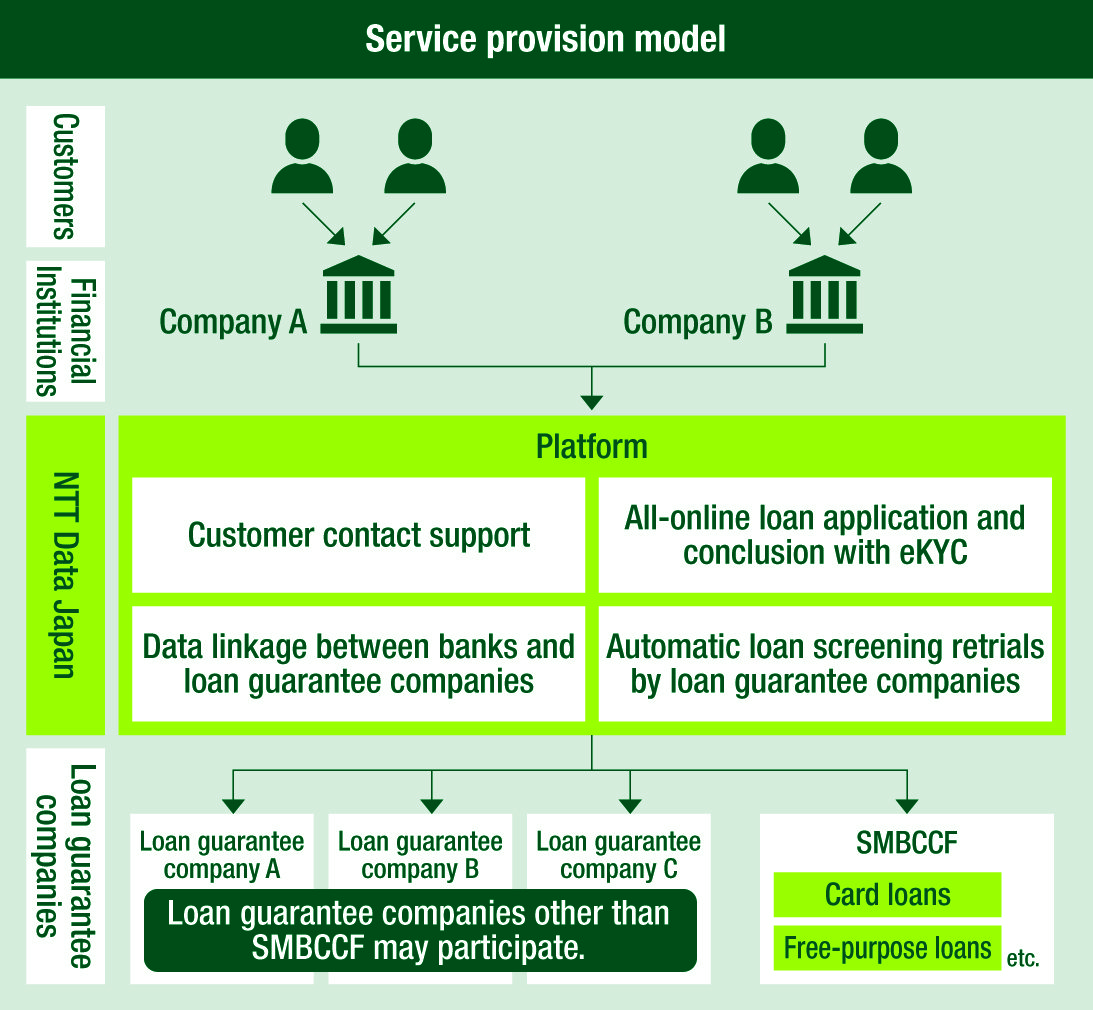

In collaboration with NTT Data Japan Corporation, we have built a platform that supports the digitalization of overall operations regarding loans, and we have begun providing the platform to financial institutions. In the personal loan business, financial institutions and loan guarantee companies are faced with inflated system costs and more complicated administrative operations. By resolving these issues through the realization of digital transformation and providing new value to financial institutions and users, we aim to contribute to the expansion of the personal loan market and become the industry standard. By utilizing the expertise we have cultivated in consumer finance, we also provide affiliated loans that can contribute to the revitalization of general business companies’ core businesses and their business diversification, thereby aiming to develop new business models.

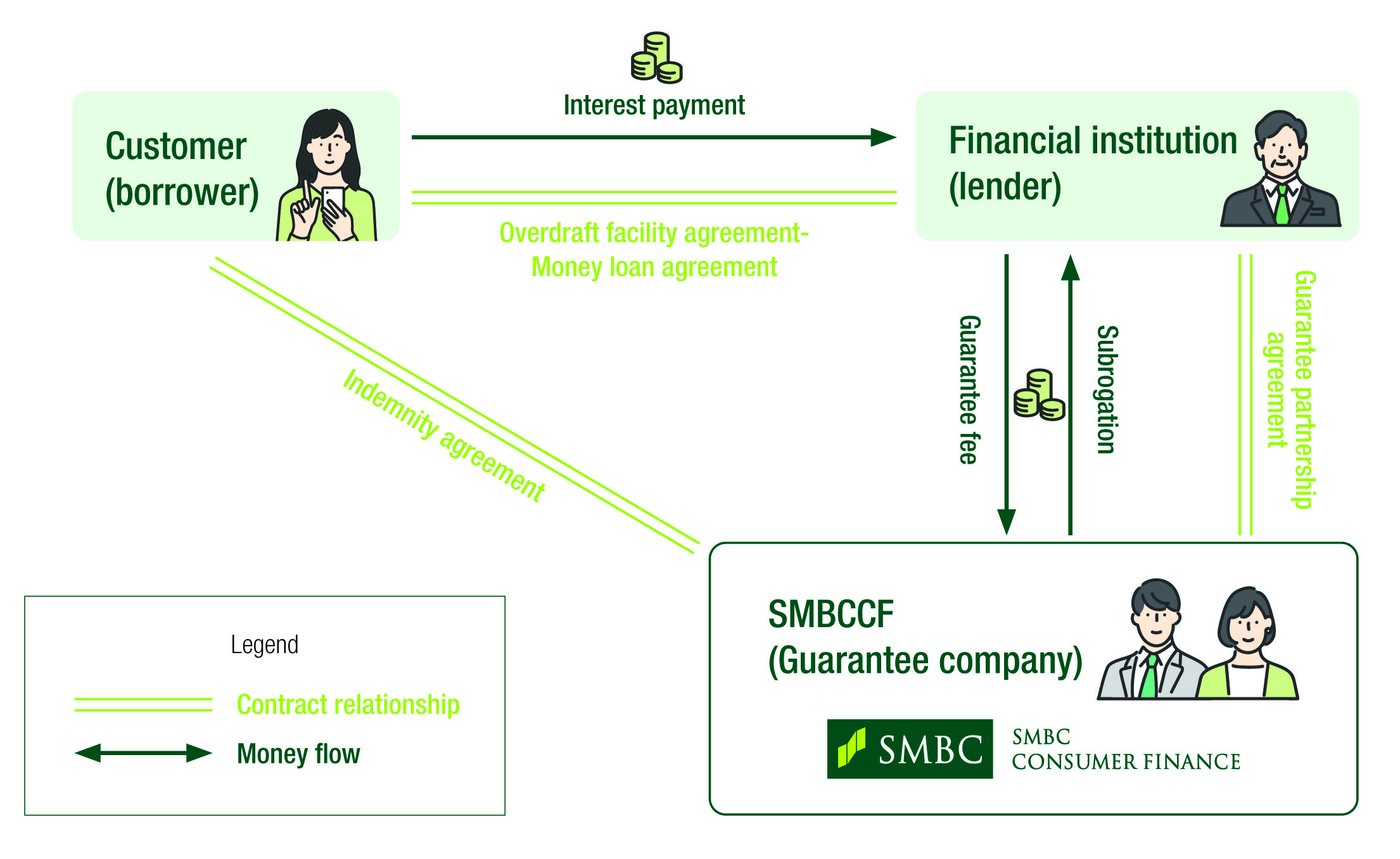

Structure of loan guarantee partnership

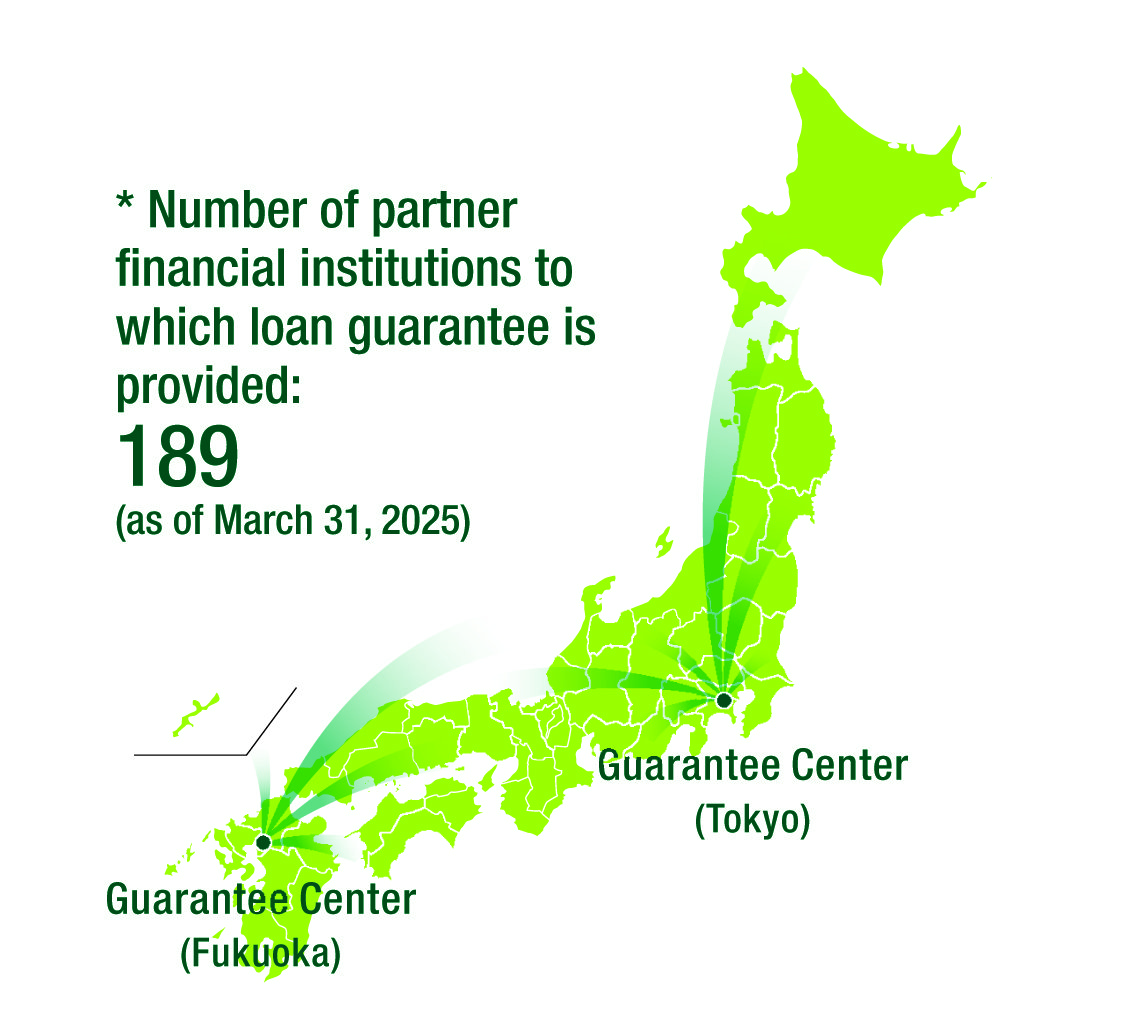

Partner financial institutions(as of March 31, 2025)

Expansion of our loan guarantee business and creation of new businesses and services

In collaboration with NTT Data Japan Corporation, we have built a platform that supports the digitalization of overall operations regarding loans, and we have begun providing the platform to financial institutions. In the personal loan business, financial institutions and loan guarantee companies are faced with inflated system costs and more complicated administrative operations. By resolving these issues through the realization of digital transformation and providing new value to financial institutions and users, we aim to contribute to the expansion of the personal loan market and become the industry standard. By utilizing the expertise we have cultivated in consumer finance, we also provide affiliated loans that can contribute to the revitalization of general business companies’ core businesses and their business diversification, thereby aiming to develop new business models.

Implementing joint advertising in the loan guarantee business

Launching a new advertising service model to improve promotional efficiency at partner financial institutions

On October 2, 2023, in the loan guarantee business, we started a service in which we provide creatives produced by our company to our partner financial institutions for use in their advertising and promotional activities.

[Advertising campaign featuring actress Mayu Matsuoka]

We have launched advertisements featuring actress Mayu Matsuoka, who has been active in a variety of fields, including TV dramas, movies, and commercials, and who is popular among both men and women of all ages. Through the natural and friendly image of Ms. Matsuoka, we express the idea that financial institutions are there for their customers and can be of assistance.

Poster

Business card size card